The cryptocurrency market, a dynamic and often volatile space, is characterized by its relentless pace of change. Understanding the daily trends and events impacting Bitcoin’s price, blockchain technology, DeFi, NFTs, Web3 development, and crypto regulation is crucial for anyone seeking to navigate this complex landscape. This analysis delves into the key elements that shape the crypto narrative, providing context, technical implications, and a future outlook.

**Bitcoin Price Dynamics:** Bitcoin, the flagship cryptocurrency, continues to exert a significant influence on the broader market. Daily price fluctuations are often driven by a confluence of factors, including macroeconomic indicators, regulatory announcements, technological advancements, and investor sentiment. Institutional adoption, or the lack thereof, plays a pivotal role. Major companies adding Bitcoin to their balance sheets can trigger bullish rallies, while concerns over regulatory crackdowns can induce sharp corrections. Technically, Bitcoin’s price movements are often analyzed using chart patterns, moving averages, and relative strength indicators to identify potential support and resistance levels. Future outlook suggests increased correlation with traditional financial markets and the potential for Bitcoin to solidify its position as a store of value.

**Blockchain Developments:** Beyond Bitcoin, blockchain technology continues to evolve at a rapid pace. Innovations such as layer-2 scaling solutions (e.g., Lightning Network, Polygon), sharding, and improved consensus mechanisms (e.g., Proof-of-Stake) aim to address scalability and efficiency challenges. These advancements are critical for enabling wider adoption of blockchain-based applications. The technical implications involve intricate cryptographic protocols and distributed ledger designs that ensure data integrity and security. Future outlook points towards the development of more interoperable blockchains, allowing seamless transfer of assets and data across different networks.

**Decentralized Finance (DeFi) Landscape:** DeFi protocols are revolutionizing traditional financial services by offering decentralized alternatives to lending, borrowing, trading, and asset management. Daily trends in DeFi are characterized by the emergence of new protocols, yield farming opportunities, and innovative financial instruments. However, DeFi also faces significant challenges, including security vulnerabilities (e.g., smart contract exploits), regulatory uncertainty, and impermanent loss. Technical implications involve the use of smart contracts to automate financial processes and the development of decentralized governance mechanisms. The future outlook suggests a continued focus on security audits, risk management, and regulatory compliance to foster sustainable growth in the DeFi ecosystem.

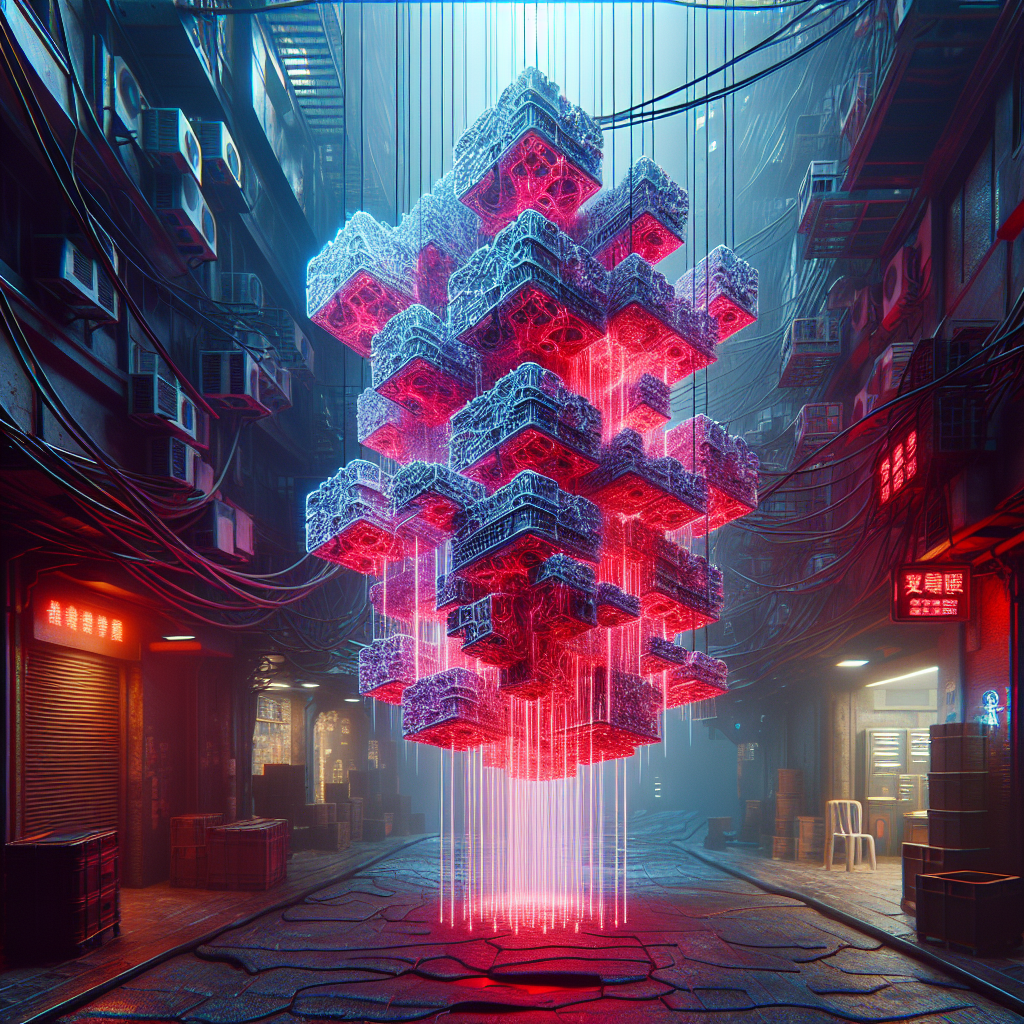

**Non-Fungible Tokens (NFTs) and Web3 Integration:** NFTs have exploded in popularity, representing unique digital assets such as artwork, collectibles, and virtual real estate. Daily trends in the NFT space include new NFT drops, evolving use cases (e.g., gaming, metaverse), and the development of fractionalized NFTs. The technical implications involve the use of blockchain to verify ownership and provenance of digital assets. NFTs are also playing a crucial role in the development of Web3, a decentralized internet built on blockchain technology. Web3 aims to empower users by giving them more control over their data and digital identities. The future outlook suggests increased integration of NFTs into mainstream culture and the development of more sophisticated Web3 applications.

**Crypto Regulation:** Regulatory developments are a major driver of sentiment in the cryptocurrency market. Governments around the world are grappling with how to regulate cryptocurrencies, with some countries adopting a more permissive approach while others are taking a more restrictive stance. Daily news regarding regulatory announcements, enforcement actions, and legislative initiatives can have a significant impact on crypto prices and adoption rates. The technical implications involve the development of regulatory-compliant solutions, such as KYC/AML protocols, and the need for transparency and accountability in the crypto industry. The future outlook suggests increased regulatory clarity, which could provide a boost to institutional adoption and mainstream acceptance of cryptocurrencies.

コメント